All businesses have to be good at one big thing – managing their accounting operations aptly.

While business owners may be true visionaries who excel at creativity and hustle, they often lack the skills to report, reconcile, and manage financial data.

Not everyone has an accounting background, and it’s completely obvious!

That's where human virtual bookkeeping assistants come in. They come with years of experience in bookkeeping.

Whether it’s small, medium, or large companies, they offer cost-effective solutions and a personal touch for businesses of all sizes.

Bookkeeping is indeed a time-consuming task. However, regular bookkeeping saves valuable time and improves a business's financial health. It also keeps the accounting system abreast.

Before hiring a virtual accounting assistant, you must clearly know what details you must share with them and what tasks they perform.

Virtual Bookkeeping Services

They handle financial data and create financial reports on time. Common tasks include:

- Data entry

- Manage financial records

- Accounts Receivable

- Accounts Payable

- Balance Sheets

- Various financial transactions

- Credit card management

- Bank reconciliations

- Tax preparations

- Tax filing

- Payroll processing

- Payment reminders

- Expense tracking

They take care of all sorts of bookkeeping needs. Not only that but if you go for a reliable virtual assistant company with diverse team members, along with online bookkeeping services, they offer a wide range of services, such as

performing administrative tasks,

handling customer service skills,

and assisting you with your hiring process (background checks of your new joiners, recordkeeping, onboarding process, etc.) with complete data security.

They manage your books throughout the year so that you don't need to make haste during the tax season to pay your taxes.

Virtual bookkeeping assistants help with cost savings in the long run. You need to share your financial information (with your remote team, and they will take care of the rest. They embrace and apply all best practices to manage all your accounting needs.

Accounting Virtual Assistants have years of experience and possess all the required skill sets to perform financial tasks.

Most importantly, they save that scarce resource in demand – your time!

Offloading your bookkeeping and accounting tasks to them frees up your time and helps you focus on your business's mainstream tasks and strategies. But who is a virtual bookkeeping assistant or virtual bookkeeper? Let us find out.

What Bookkeeping Software to use?

Popular bookkeeping software options for small to medium-sized businesses include:

- QuickBooks Online: Widely used, scalable, and offers various plans for different business needs.

- Xero: Intuitive interface, robust invoicing features, and integration with various third-party apps.

- FreshBooks: Ideal for freelancers and service-based businesses, focusing on invoicing and time tracking.

- Wave Accounting: Free for basic features, a good option for startups and small businesses.

- Zoho Books: Part of the Zoho suite, it offers a comprehensive accounting solution with integrated CRM.

The choice of bookkeeping software depends on your business's specific needs and budget—a software that allows you to manage your complete financial operations smoothly. Before deciding, consider factors like the number of users, required features, ease of use, and integration with other business tools. Before subscribing to accounting software, try their free trial and demo. If you are not using any software now, you can consult any online bookkeeping service provider and seek their recommendation.

Some accounting software offers a specific user interface for business categories like real estate, e-commerce, etc. One more factor we need to remember before subscribing to any business management software is its customer support track record or whether it has a call center operating during work hours. For instance, if you're based in the United States, you prefer the software provider to offer solutions immediately during business hours.

We offer free consultations and exclusive trials to help you find and use the most feasible software for your preferences and business needs.

Definition of Virtual Bookkeeping Assistant

The process of organizing and keeping track of all the business transactions that occur during a business is called bookkeeping. Virtual bookkeeping assistants provide the exact accounting services from a remote location other than your office. Hiring virtual bookkeepers has become common, saving busy professionals time, money, and energy. From corporate conglomerates to mom-and-pop stores, bookkeeping tasks are in demand for all the right reasons.

Traditional Bookkeeping vs. Virtual Accounting Services

Traditional bookkeeping and virtual accounting services aim to maintain accurate financial records for businesses. Both are skilled professionals and provide similar financial support, but their delivery methods differ.

Traditional Bookkeeping:

- In-House: Typically involves an in-house or locally hired bookkeeper who works on-site at the business's premises.

- Physical Records: Relies on physical documents, ledgers, and manual data entry.

- Limited Access: Financial data may be less accessible outside business hours or when away from the office.

- Costs: Costs may include salary, benefits, office space, software, and hardware.

Virtual Accounting Services:

- Outsourced: Services are provided remotely by a team of accounting professionals.

- Cloud-Based: Utilizes cloud-based software for real-time collaboration and data access from anywhere with an internet connection.

- Automation: Leverages automation for tasks like bank reconciliation, invoicing, and report generation.

- Scalability: Services can be easily scaled up or down based on the business's needs.

- Cost-Effective: Often more cost-effective than hiring a full-time bookkeeper, as businesses only pay for the services they need.

Which is Right for Your Business?

The best choice for your business depends on various factors:

- Business Size: Small businesses and startups might find virtual accounting services more affordable and flexible.

- Budget: Virtual accounting can often be more cost-effective due to lower overhead costs.

- Technology Comfort: Businesses comfortable with technology and cloud-based solutions might prefer virtual accounting.

- Data Access: If real-time access to financial data from anywhere is essential, virtual accounting is advantageous.

Virtual accounting services may be better if you seek a cost-effective, scalable, and technologically advanced solution with remote access. However, traditional bookkeeping could be suitable if you prefer a more conventional, in-person approach and have the budget for a full-time bookkeeper.

Research and compare different providers to find a solution that meets your business's specific requirements and budget.

Let me know if you have any other questions.

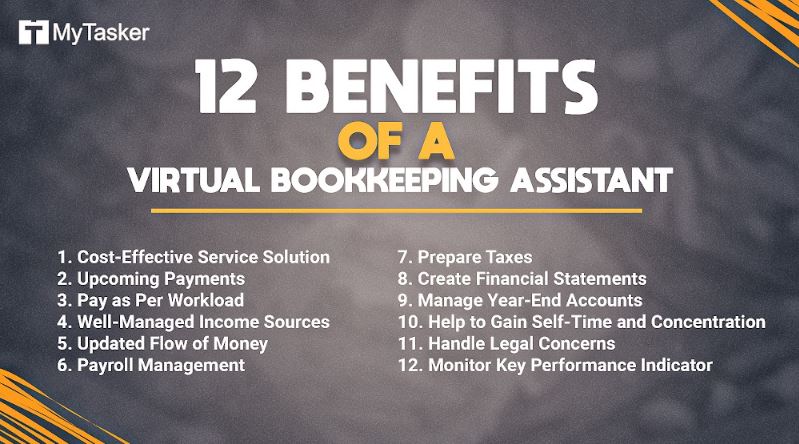

Benefits of Hiring a Virtual Bookkeeping Assistant

There are several advantages to hiring a virtual bookkeeping assistant. Some of those are discussed below:

- Cost-Effective Service Solution: Hiring a virtual assistant rather than an in-office employee can save you precious bucks. Why? You need not spend on employee benefits, insurance, employment taxes, office space, office supplies, and other aspects that come with part-time or full-time employees.

- Upcoming Payments: Your virtual bookkeeper can shoulder your responsibility for managing all forthcoming payments. You can also give them access to take care of the invoices from suppliers or creditors. They can keep track of the balance in your business account and give you regular updates, which will help you better understand how business operations are in place.

- Pay as Per Workload: This is one of the best parts. You can hire virtual bookkeeping assistants appropriate to your workload and the attention they require. The option to pay them only when you need them and not regularly is a double whammy. It keeps unnecessary spending in check.

- Well-Managed Income Sources: Maintaining each client's account separately is necessary to measure individual performance. This makes it easy to figure out the whole picture in detail. However, as a business owner, you may often be pressed for time and find it difficult to maintain each account efficiently, especially when your business grows. An efficient virtual bookkeeper can help you in such circumstances as they are well-versed with advanced accounting software that can track all your transaction trails.

- Updated Flow of Money: Outsourcing a virtual assistant for accounting can help keep track of the flow of money. The virtual assistant is responsible for taking notes on accounts payable and outstanding, tracking receipts, and other related work. The result is a clear picture of where the money is coming from and where it's going.

- Payroll Management: Payroll management is a hectic task. If you want to concentrate more on your business than the additional matters, consider hiring a virtual bookkeeping assistant to manage such account-related things.

- Prepare Taxes: Hiring a virtual bookkeeper is an excellent solution if you are worried about the Internal Revenue Service's deadlines. They will care for your taxable accounts and ensure all report submissions are made within the deadline. That's one weight off your chest! Indeed, managing tax filings and ensuring that you file your returns on time are integral parts of a virtual bookkeeper's job.

- Create Financial Statements: While running a business, you can feel the need to create financial statements for various reasons. With a virtual bookkeeper, you can easily get profit, loss, and balance sheet statements without hassle.

- Manage Year-End Accounts: Virtual bookkeeping assistants also help you with year-end accounting. They can reconcile numbers to match your bank statement and ensure that it matches the financial software display, thus providing no erroneous or duplicate entries.

- Help with time management: Your virtual bookkeeper helps you by taking care of the crucial business of accounts and, thus, allows you to leverage your time for other core business functions. Hiring them can also free up your time with your near and dear ones.

- Handle Legal Concerns: As a business owner, keeping track of changing tax laws and handling legal and regulatory concerns can be challenging. This is in addition to strategic planning and other business-related matters. A virtual bookkeeper can be of great help, as it is part of their job to be up-to-date with the latest tax laws and legal bindings in the market.

- Monitor Key Performance Indicator: Hiring a virtual assistant for accounting allows you to monitor your business's finances better. Virtual bookkeepers also keep track of your Key Performance Indicators (KPIs) so that you can assess your company's financial standing.

Where to find a Virtual Bookkeeping Assistant?

- Virtual Assistant Companies: Many specialize in bookkeeping and have teams of skilled professionals.

- Freelance Platforms: Websites like Upwork and Fiverr connect you with freelance bookkeepers worldwide.

- Online Bookkeeping Service Providers: Companies dedicated to providing online bookkeeping services with user-friendly platforms and transparent pricing.

- Accounting Software Providers: Some offer bookkeeping services as part of their packages or have certified advisors.

- Referrals: Ask for recommendations from other business owners, colleagues, or professional advisors.

When choosing a provider, consider their experience, pricing, technology, communication, and security measures.

At MyTasker, we offer various virtual assistant services (payroll services, tax reporting, preparing expense reports, and maintaining accurate records of journals and ledgers). Our bookkeeper assistants help you with your accounting needs and play an active role in your business growth.

Outsourcing bookkeeping is no longer a challenge! We offer high-tech work infrastructure to manage sensitive data carefully, bank account details, and transactions. We also offer other services, such as social media management and Excel assistance.

MyTasker remote teams work during different work hours. With us, your accounting system is in safe hands.

Like your in-house bookkeeper, you don't need to pay a salary and bonus to your virtual bookkeeping assistant salaries. Remote work is magic!

Contact us for a free consultation to discuss your needs.